In today’s latest World Economic Outlook (WEO) the IMF devotes a large-ish section to gold and other precious metals (p.47 onwards here).

Perhaps the most interesting section is on whether they serve as an inflation hedge. Finding a positive but weak correlation to inflation itself, the analysts also look at gold prices against modelled inflation risks. Here they are more positive, saying:

Results of the analysis support the view that precious metal prices react to inflation concerns… An increase in inflation uncertainty by one standard deviation tends, within a month, to raise the price of gold by 0.8 percent and silver by 1.6 percent. A decline in inflation uncertainty can explain half of the observed gold price decline of the 1990s and one-third of the price rise after 2008. The role of inflation uncertainty is, instead, positive but not significant for platinum and palladium, yet irrelevant for copper

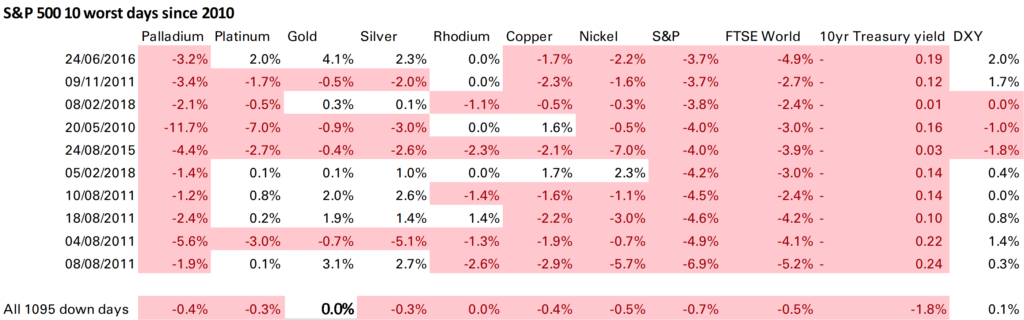

For many gold’s main advantage is not inflation but against systemic risk. The IMF also looks at this through reactions to S&P 500 moves. This is something I have long done, and the IMF’s conclusions are the same – gold does act as a safe haven when the S&P 500 falls, silver does but less so, and the other metals do not. Here’s one of my versions of this table.

Finally the IMF also mentions precious metals’ sensitivity to dollar moves. But only to express surprise the beta can sometimes be more than 1 (ie if the dollar falls 1%, gold rises more than 1%). I think this relationship – which is partly obvious given we are quoting the price in dollars – needs more discussion and will do so in a later post.