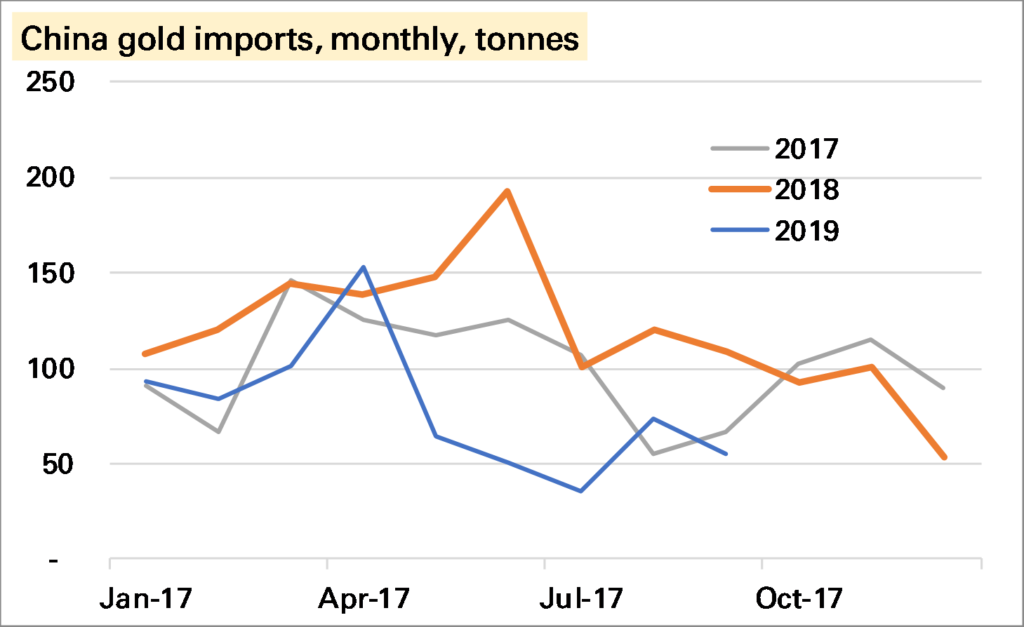

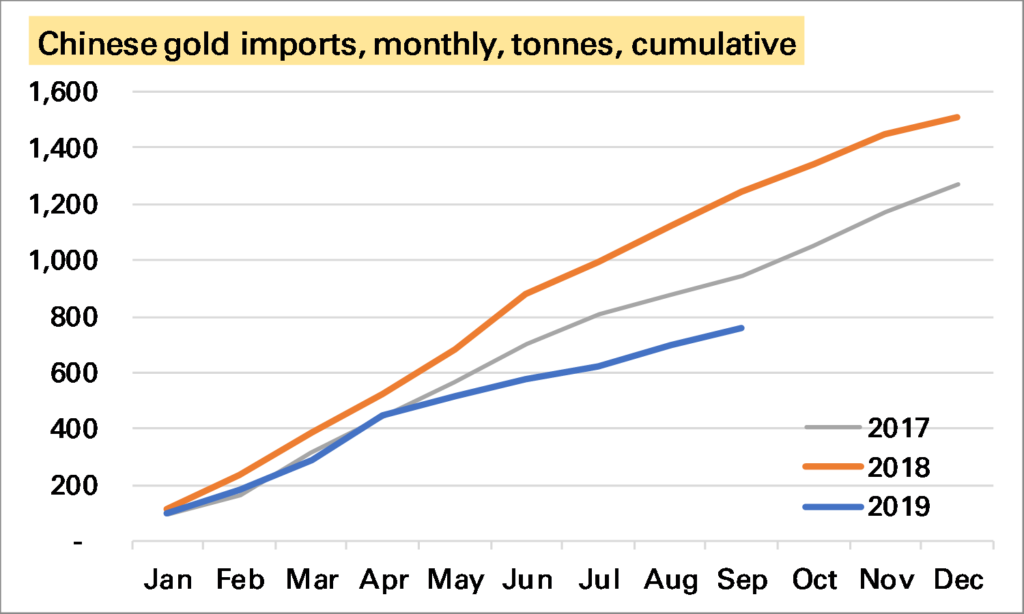

China imported 62t of gold in September, according to recently released customs data. This is slightly down on last month, above the lows of summer, but subdued compared to earlier in the year and in 2018.

Gold imports in the first nine months of the year have totalled 760t, more than a third lower than the 1,242t seen at the same point of 2018.

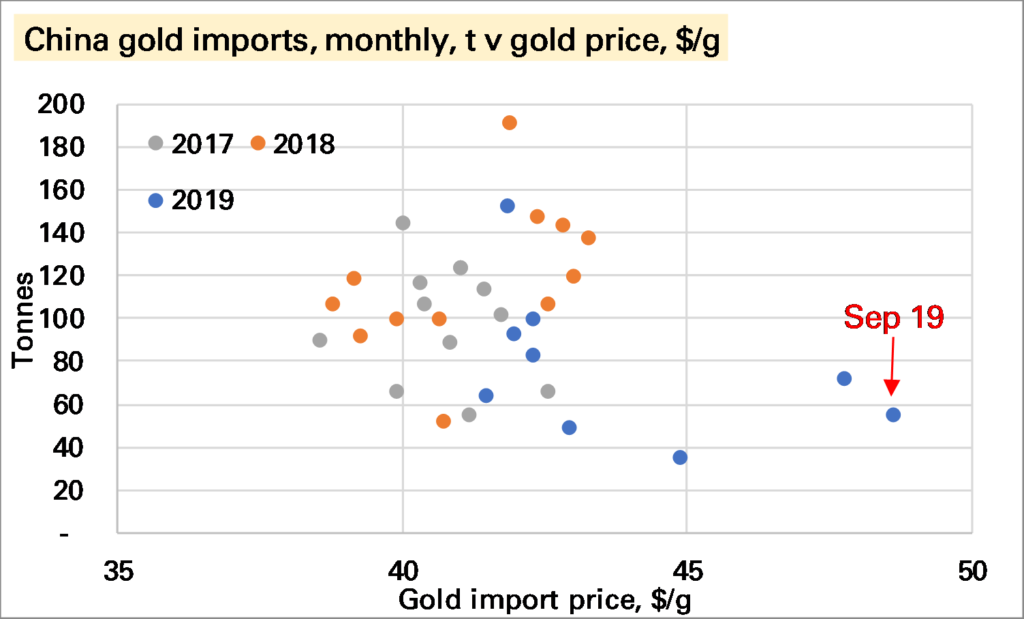

Of course one factor is the much higher gold price, with western ETF investors bidding up the price.

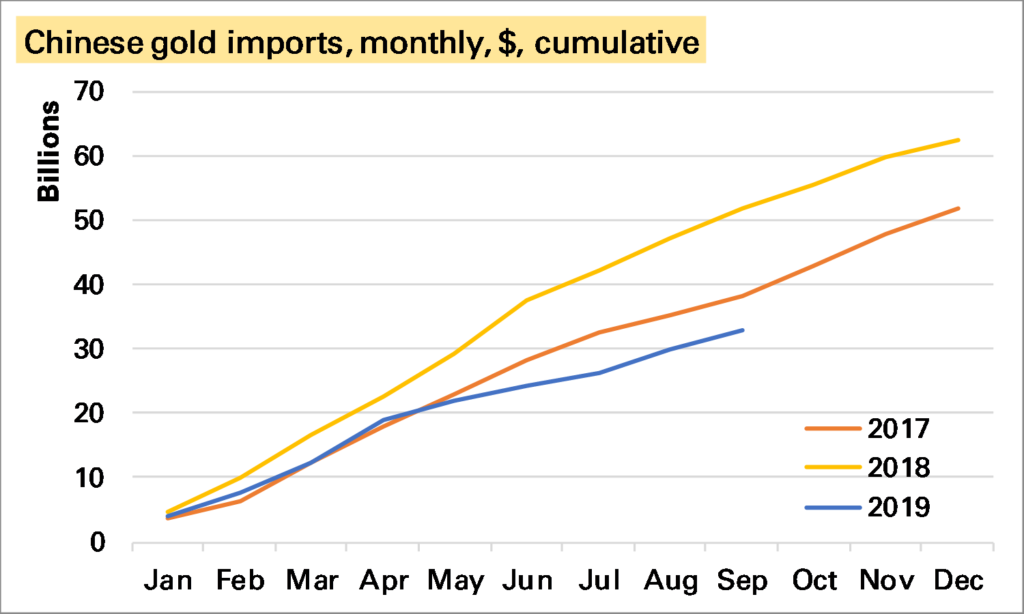

But in terms of value of gold imported 2019 is also proving a weaker year than 2018, and even, since the start of summer, with 2017.

Is this something for the bulls to worry about? This Reuters story placed the blame for the very weak summer period on quotas restrictions aimed at restricting the outflow of Yuan. These were apparently eased in August, helping explain why imports have picked up a bit. Presumably at the LBMA conference in Shenzhen more was said about this. Such restrictions do suppress gold demand but if only temporary are unlikely to do lasting damage.

Furthermore there is a real sense, despite all the talk of gold being a 200,000t “stock” market, that if ETF investors are buying a lot of gold, the Chinese can’t have as much. The price rises to see who wants it most. So it’s certainly not as concerning as it looks.

Nevertheless it remains concerning. The biggest risk to the gold market medium-term, in my view, is lacklustre”physical” demand, of which over 50% comes from China and India. In particular it seems to me that gold – both as a consumer good and an investment good – now faces far more competitors (eg smartphones, index-linked bonds) than it once did. Of course some of its qualities are unique and it has a long track-record, suggesting a certain robustness. But it pays to not be complacent.

For the background on how China now publishes gold trade data see my LBMA Alchemist piece from earlier this year.