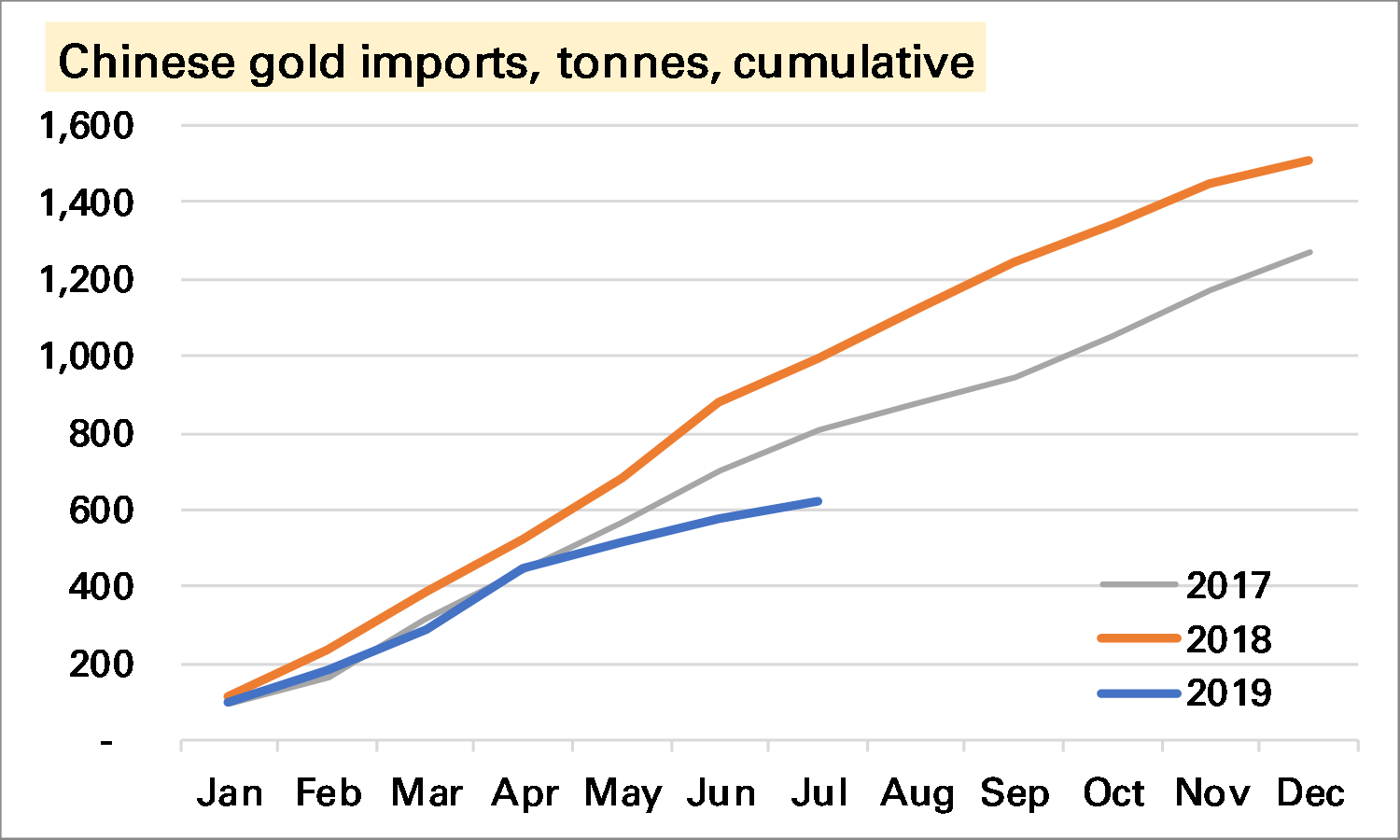

Chinese gold imports were weak again in July, 43t, and the YTD total is now just over 600t, compared to over 1,000t during the same period of 2018.

Is this something for the bulls to worry about? This Reuters story places the blame squarely on quotas restrictions aimed at restricting the outflow of Yuan. If correct this will be artificially suppressing gold demand, but history suggests such periods don’t last long. And it makes sense that if ETF investors are buying a lot of gold, the Chinese can’t have as much. That’s why the price rises. So it’s certainly not as concerning as it looks.

Nevertheless we must continue to pay attention to it. The biggest risk to the gold market medium-term, in my view, is lacklustre”physical” demand, of which over 50% comes from China and India. In particular it seems to me that gold – both as a consumer good and an investment good – now faces far more competitors (eg smartphones, index-linked bonds) than it once did. Of course some of its qualities are unique and it has a long track-record. But that might not be enough.

For the background on how China now publishes gold trade data see my LBMA Alchemist piece from earlier this year.